Some people wish to share their estate between an association and the loved ones who have marked their lives. Sometimes, however, these are indirect heirs, who may have to pay substantial inheritance tax. There is a form of bequest, the bequest with charge, which simplifies the formalities for loved ones, while leaving the possibility of keeping one's values alive for a cause.

Françoise, single and childless, made this choice. She wanted to leave a legacy to Planète Enfants & Développement, while at the same time rewarding her niece, with whom she has a very close relationship. She therefore opted for a bequest with encumbrance, also known as a bequest net of charges and duties.

> Discover Françoise's story in our free booklet

Inheritance tax

In France, when you inherit assets from your parents or grandparents, you benefit from a substantial tax allowance. It's only when this amount is exceeded that you have to pay inheritance tax.

However, as soon as the beneficiary of an inheritance is a more distant heir or someone who does not belong to the family, the allowance is low, or even non-existent. Inheritance tax then takes a heavy toll on the inheritance...

To protect such beneficiaries, a bequest with encumbrance appears to be a judicious solution, click here to find out more.

Legacies with encumbrances: mechanism

A bequest with encumbrances includes conditions or obligations to be fulfilled by the universal legatee (the beneficiary who receives the entire inheritance). As the beneficiary of a bequest with encumbrance, an association such as Planète Enfants & Développement must fulfill the obligations of the bequest; for example, transferring a share of a sum of money received, net of fees and taxes, to a designated heir.

> Ask for our free, no-obligation booklet

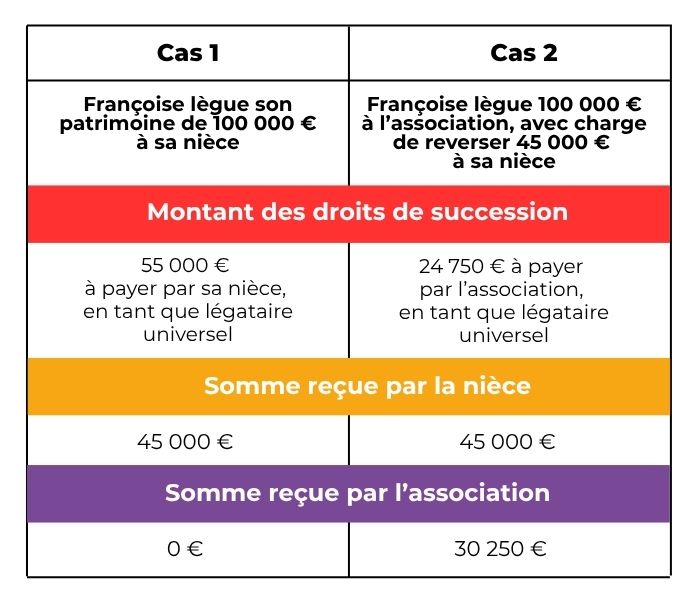

Example and comparison

In the first case, Françoise decided to bequeath her entire estate to her niece with a classic bequest. Her niece receives €45,000, with the remainder going to the state.

In the second case, she decided to leave a legacy of €100,000 to Planète Enfants et Développement, with the proviso that she pass on €45,000 to her niece. In addition to the sum her niece would have benefited from in the 1st case, she donated €30,250 to the association.

As you can see here, a bequest with encumbrance enables you to pass on to a relative, even one who is fiscally distant (niece, friend, etc.), an amount net of fees and taxes equivalent to what he or she would have received with a direct bequest.

What's more, it spares the heir the administrative procedures associated with inheritance tax, which in the case of a traditional transfer often has to be paid by the heir even before he receives the inheritance (a constraint which, when the tax is high, can lead to the estate being abandoned).

In this arrangement, the association is responsible for all costs and formalities.

> Discover other philanthropic stories in this booklet

If, like Françoise, you would like to pass on your legacy to Planète Enfants & Développement and your loved ones, and would like to find out more about bequests with encumbrances, I invite you to contact me so that we can talk by telephone or e-mail.

Sylvie Morin-Miot

In charge of the Transmission of Patrimony

Mail : sylvie.morin-miot@planete-eed.org

Tel : 01 53 34 86 32

Accompanied by Maître Massuelle, notary

Planète Enfants & Développement, as an association whose sole purpose is charitable assistance, is entitled to receive bequests and donations exempt from transfer duties.

(Securing the administrative doctrine - Agreement with the Prefecture - Article 158 of Finance Act no. 2020 - 1721 of December 29, 2020 - New wording of article 795 4° of the General Tax Code).