Every day, the generosity of our donors enables Planète Enfants & Développement to carry out important projects for children and their families around the world. There is another form of support, which is still fairly confidential, but which can make a significant contribution to our actions: bequests and life insurance transfers.

I know that thinking about your will and the transfer of your assets is a stage in life that ultimately raises a lot of questions. When I talk to some of you, some of these questions come up again and again. So I've decided to share with you the answers to the questions I'm most often asked.

"I feel ready to write my will, but I don't know where to start."

Don't worry, it's quite usual. First of all, it's important to take your family situation into account: depending on the composition of your family (marital status and number of children), you may have to reserve part of your inheritance for family members, under the "reserve héréditaire" rule.

Next, you need to think about the remaining part of your estate: what you want to leave and to whom (family, friends, charitable organization, etc.).

Last but not least, it's a good idea to make an appointment with a notary to help you draw up your will.

"What is the hereditary reserve?"

Inheritance reserve refers to the portion of your estate that you must allocate to certain members of your family: your children and possibly your spouse.

This share varies according to your family situation.

If you have 1 child, you are required to leave half of your estate to him or her. This share amounts to ⅔ if you have 2 children and ¾ from 3 children.

If you have no children and your spouse survives you, ¼ of your estate goes to him or her.

Do you think your family situation doesn't fit the above criteria? Please do not hesitate to contact me so that together we can determine your inheritance reserve.

"What should my will contain?

Your will enables you to allocate parts of your estate (property or money) to designated beneficiaries. It is therefore essential to be as precise as possible about the transfers you intend to make.

This document must also meet the following criteria to be valid:

- be handwritten (by you or a notary)

- include the date on which it was written

- be signed by the author of the will

"From what amount does Planète Enfants & Développement accept bequests or life insurance transfers?"

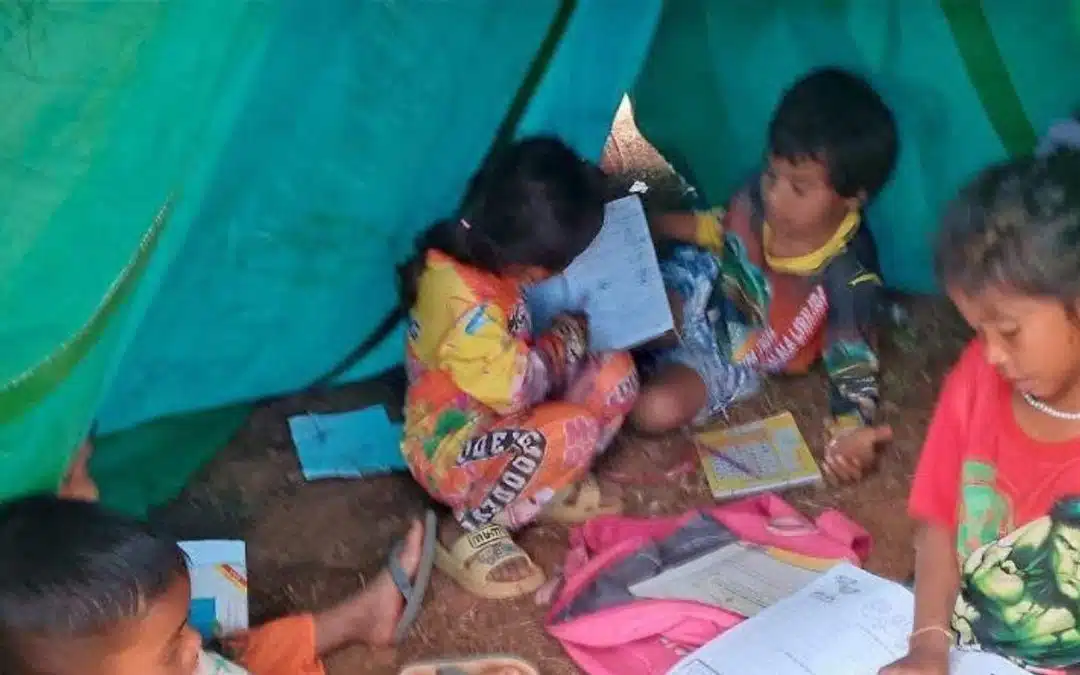

Every time a legacy is passed on, Planète Enfants & Développement is able to protect and help educate children in Asia and Africa. There are no "small bequests", and the amount is not a criterion for admissibility! The Planète Enfants & Développement teams are grateful for every contribution that supports their mission, and accept them all. The sum of small contributions makes us grow, and large contributions allow us to multiply what we know how to do.

"What are the advantages of transmitting to Planète Enfants & Développement?"

There are several advantages to making a bequest or transferring your life insurance policy to an association like Planète Enfants & Développement:

On the one hand, you are ensuring that the values you have upheld throughout your life will live on. We are proud to honor your memory and your trust, the human-sized Planète Enfants & Développement team will do everything in its power to ensure the protection and education of children, girls and women, and improve the lives of thousands of families in distress.

What's more, you can take advantage of a number of tax breaks since, unlike natural persons, associations recognized as being in the public interest, such as Planète Enfants & Développement, are not subject to inheritance tax. As a result, they receive the full amount of the bequest. It is even possible to pass on these tax advantages to your loved ones outside your inheritance reserve, by designating the association as universal legatee and leaving it in charge of giving what you wish to your loved ones.

I hope that the answers to these questions will help you to gain a clearer picture of your transfer project. Nonetheless, I'm well aware that the transfer of assets is a vast subject, particularly in terms of each individual's personal situation. So I'd be delighted to provide you with any additional information you may require. Please do not hesitate to contact me by email or telephone to arrange a meeting!

Sylvie Morin-Miot

In charge of the Transmission of Patrimony

Mail : sylvie.morin-miot@planete-eed.org

Tel : 01 53 34 86 32

Accompanied by Maître Massuelle, notary

Brochure request,

free of charge and without obligation

* Mandatory fields to receive the brochure